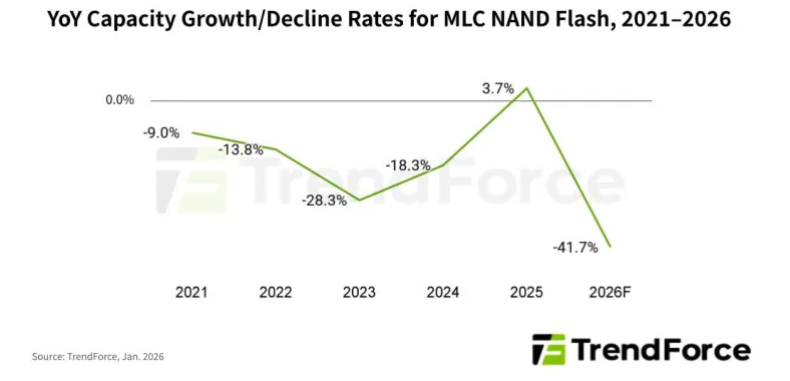

MLC NAND flash capacity is expected to decrease by 41.7% YOY in 2026 as major makers reduce or halt their output.

As major international NAND Flash producers reduce or halt MLC (multi-level cell) NAND flash output and redirect their capital and R&D investments toward advanced process tech, the worldwide MLC NAND flash capacity is expected to decrease by 41.7% year-on-year (YOY) in 2026, leading to increased supply-demand discrepancies, according to TrendForce’s recent research.

The significant decline in MLC NAND Flash supply is mainly due to Samsung—formerly the largest supplier—announcing in March 2025 that its MLC NAND products would reach end of life, with final shipments in June 2026. Additionally, Kioxia, SK hynix, and Micron have limited their MLC production primarily to meet existing customer demand, with little motivation to increase capacity. As supply rapidly contracted and no large, quickly ramping replacement capacity appeared, the MLC NAND flash market experienced strong pull-in demand and early volume commitments from late 1Q 2025, causing prices to rise sharply and maintain this upward trend.

TrendForce observes that demand for MLC NAND flash in end markets remains fairly stable, primarily driven by industrial control, automotive electronics, medical devices, and networking equipment. These sectors have strict demands for reliability, write endurance, and long-term supply commitments. However, the long-term growth outlook for these applications remains limited. Furthermore, if certain use cases drive adoption of improved TLC solutions, or if the overall NAND flash market enters a clear cyclical downturn, the price of MLC NAND could still face indirect downward pressure.

As long-term supply gaps appear in the MLC NAND Flash market, Taiwan’s Macronix, traditionally focused on embedded and high-reliability memory markets, has a competitive edge in serving this niche. The company has already scaled down some of its NOR Flash capacity to increase its MLC NAND Flash production.

This change is projected to reduce global NOR Flash capacity and boost supply concentration, which should ease the historical pricing pressures from excess capacity. Consequently, prices for mid- to high-density NOR Flash products are expected to receive stronger support in the future.