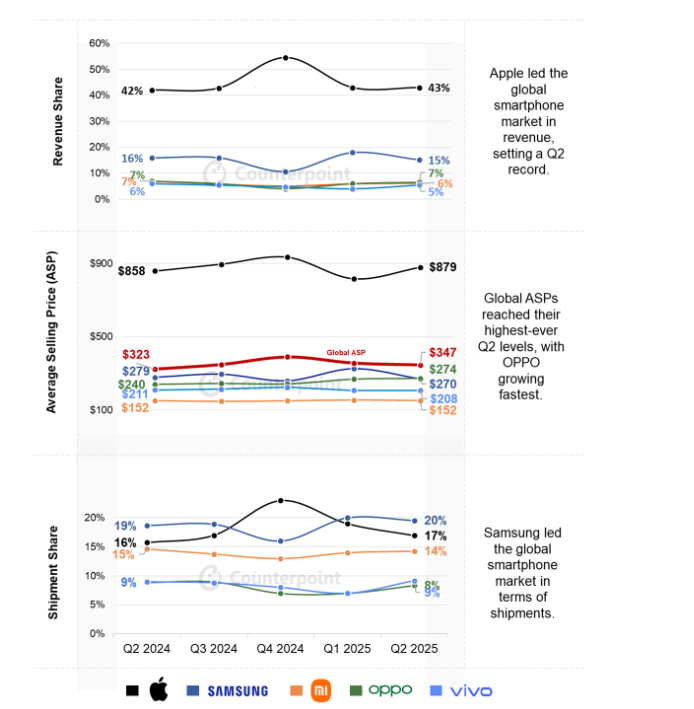

Global smartphone revenues grew by 10% year-on-year (YoY) in the second quarter (2Q 2025) to exceed $100 billion, the highest level in a second calendar quarter to date, according to Counterpoint Technology Market Research’s latest Market Monitor service.

In contrast, global shipments saw a meager 3% YoY rise during the quarter. Meanwhile, the global average selling price (ASP) also hit a second-quarter peak, rising by 7% YoY to approach $350.

Global Smartphone Market Revenue Grew 10% YoY, Reaching Record Q2 Levels

Source: Counterpoint Market Monitor Service Preliminary Data

OPPO includes OnePlus since Q3 2021

ASP is based on wholesale price

“The market witnessed both volume and value growth despite ongoing macroeconomic headwinds in several key regions. Amid the easing out of US tariffs, OEMs benefitted from robust demand for premium devices, especially in developed markets. Premiumization has accelerated beyond earlier projections, propelled by expanded access to financing options, enhanced trade-in initiatives, and heightened promotional activities – all of which are effectively lowering the barrier to entry for higher-end devices,” said Senior Analyst Shilpi Jain.

“Apple strengthened its lead in revenues driven by strong performance of the 16 series across geographies, benefitting from the broader premiumization trend. Shipments in the US were front-loaded in the quarter due to tariff uncertainties. Meanwhile, the iPhone 16e drove sales in Japan, making it one of the fastest growing regions for Apple. Emerging markets like Middle East Africa, and India continue to show strong growth,” said Research Director Jeff Fieldhack.

Samsung retained its leadership position in terms of global smartphone shipments in 2Q 2025, while its revenue grew by 4% YoY. The brand’s growth was largely driven by strong demand for its refreshed mid-tier A-series devices across regions, while the Galaxy S25 series, along with the newly added S25 Edge, drove volumes in the premium segment.

OPPO’s ASP rose 14% YoY in Q2 2025, the highest among the top five brands, while its revenue rose 10% YoY. Despite a drop in volume, OPPO’s ASP and revenue grew due to the company’s continued push into the premium segment driven by the Reno 13 series and Find X8.

vivo’s Q2 2025 revenue recorded a modest 4% YoY rise while shipments grew 5% YoY. The brand continued to expand in markets like India, the Middle East and Africa, and Latin America, while gradually increasing its share in Europe.

Looking ahead, we expect the premiumization trend to continue, with revenue growth outpacing volume growth in 2025. Additionally, growing interest in GenAI smartphones and foldable form factors will likely offer significant growth opportunities for the smartphone market.