Global cellular IoT module shipments continued to rise in the first quarter (1Q 2025), growing by 16% year-on-year (YoY), according to Counterpoint Technology Market Research’s latest Global Cellular IoT Module and Chipset Tracker by Application, Q1 2025. The growth was primarily driven by strong demand in India, China and Latin America, particularly in smart metering, point-of-sale (POS) and asset-tracking applications.

“China reinforced its lead in the global cellular IoT module market with 19% YoY growth, driven by 5G and Cat 1 bis adoption across POS, asset tracking, industrial and automotive applications. India and Latin America are following suit, capitalizing on affordable connectivity to digitize utilities and tracking applications. India saw the highest growth in 1Q 2025 at 32% YoY, fueled by smart meter rollouts backed by supportive government policies. In contrast, North America and parts of APAC declined due to muted demand and macroeconomic headwinds,” Principal Analyst Tina Lu said. “5G emerged as the fastest-growing technology, surging 37% YoY, driven by growth in the router/CPE and automotive segments, especially in China. 4G Cat 1 bis is becoming the de facto standard for mass-market IoT deployments. Its shipments rose 35% YoY, driven by its optimal balance of performance and cost. 4G Cat 1 bis’ affordability, broad network support and design simplicity make it ideal for high-volume, low-complexity applications such as asset tracking and metering, disrupting legacy IoT strategies across multiple verticals.”

Vendor performance

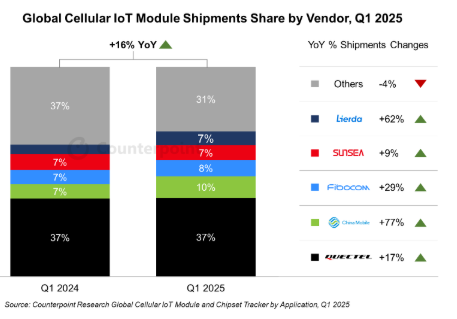

Quectel retained its top position globally. China Mobile and Fibocom followed closely. The top three accounted for more than half of global module shipments.

China Mobile recorded a double-digit global market share, fueled by strong domestic demand for 4G Cat 1 bis modules across POS, asset tracking and industrial applications. In markets outside China, Telit Cinterion maintained its second position behind Quectel.

With declining average selling prices (ASPs) for modules and chipsets, vendors are under increasing price pressure from Chinese competitors, leading to shrinking margins. As a result, many are shifting focus to more profitable segments. A notable example is u-blox, which recently exited the cellular IoT module business to concentrate on its core strengths in GNSS and short-range connectivity.

“Qualcomm maintained its top position, followed by ASR and UNISOC. ASR has nearly doubled its market share over the years, driven by its dominant presence in the 4G Cat 1 bis chipset segment,” Research Analyst Hanumant Pawar said.

Meanwhile, initial 5G RedCap deployments have begun in regions like China and North America. So far, key applications for 5G RedCap include surveillance cameras, smart glasses, routers and MiFi devices. In the next couple of years, affordable 5G RedCap modules are expected to drive significant growth, particularly in China, driven by expanding penetration of standalone (SA) 5G network coverage in the country and its government’s initiatives.

The cellular IoT module market is projected to grow steadily through 2025, driven by rising demand for smart connected devices, asset tracking, and automotive applications, especially in emerging markets. However, growth will be tempered by geopolitical tensions, vendor repositioning, and supply chain dynamics that continue to influence regional strategies. Chinese cellular IoT module vendors are poised to maintain their global leadership as the market rebounds in H2 2025. Meanwhile, Western vendors are expected to see a shipment uptick driven by recovering demand and improving geopolitical situation.